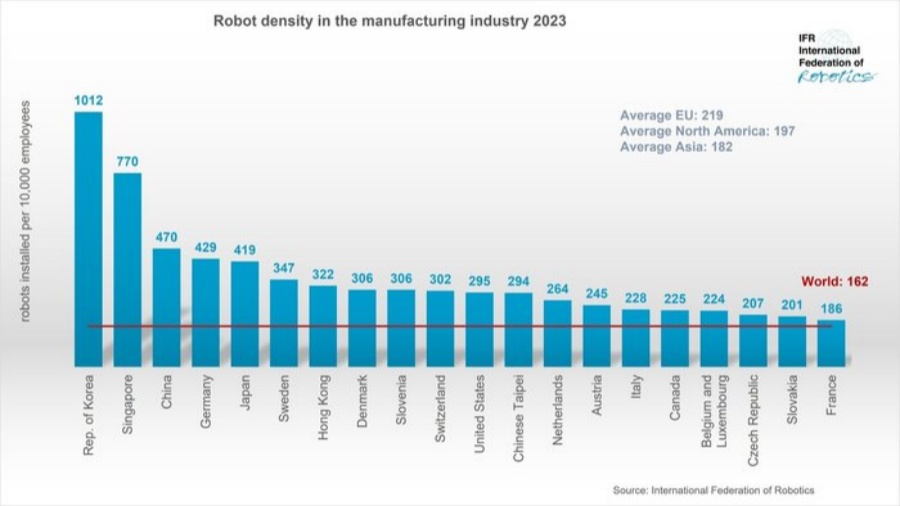

Recently, the International Federation of Robotics released its latest report showing that the global scale of industrial robot installation is expanding, and the global density of industrial robots has doubled in seven years. Data shows that in 2023, the global industrial robot density will reach a record high of 162 per 10,000 employees, twice as much as seven years ago.

It is worth noting that China has ranked third in the world in terms of industrial robot density, with 470 robots per 10,000 employees, second only to South Korea and Singapore. This is due to my country's continuous promotion of the use of automation technology in recent years, which has released the potential of the industrial robot market and is the main driving force for the development of the global robot industry.

As the manufacturing industry continues to increase the level of digitization, automation and intelligence in the production process, including the deployment of industrial robots, not only has production efficiency been greatly improved, making my country the world's largest consumer of industrial robots, but also the world's largest industrial robot market for 11 consecutive years.

In 2023, the global installed base of industrial robots will reach 541,300 units, of which my country will have 276,000 units, accounting for 51% of the global installed base. By 2023, the total number of industrial robots in my country will be 1.8 million units, ranking first in the world.

It should be pointed out that in the past, the main market share of China's industrial robot market was occupied by manufacturers such as FANUC, ABB, Yaskawa, and Kuka. Today, domestic industrial robot brands have also developed rapidly, and excellent industrial robot manufacturers such as Estun and Inovance have emerged, and their sales have continued to grow. According to MIR Rui Industrial data, the sales of domestic industrial robots have exceeded those of foreign brands.

In the first three quarters of 2024, the cumulative sales of industrial robots in China were about 216,000 units, a slight increase of 5% year-on-year. Although the overall market demand is weak, it still maintains a certain resilience. Among them, domestic manufacturers in China maintain a relatively strong growth momentum. In the first three quarters of 2024, the year-on-year growth rate of domestic industrial robot manufacturers reached 21.1%, far higher than the overall market growth rate.

In the competition with foreign brands, China's domestic manufacturers have maintained a relatively strong growth momentum, resulting in a continuous increase in the market share of domestic brands, which now exceeds 50%.

Domestication rate of industrial robots in Q1-Q3 2015-2024 (data source: MIR DATABANK)

In the first three quarters of 2024, the market share of domestic manufacturers increased to 51.6%, an increase of 4.5 percentage points from the same period in 2023. The position and influence of domestic manufacturers in the market have been further enhanced.

Among domestic industrial robot manufacturers, Estun, Inovance, Efort, and STEP performed well, ranking 2nd, 3rd, 8th, and 10th respectively. Thanks to the accelerated domestic substitution in recent years, the market share of domestic manufacturers has continued to increase, firmly occupying a favorable position in the market competition.

Finally, manufacturing enterprises promote the upgrading of intelligent manufacturing with digitalization and intelligence as their characteristics, and production efficiency has been greatly improved. In the context of manufacturing upgrading, as the digital transformation of manufacturing continues to deepen, it drives a surge in demand for industrial automation and industrial robots. In the long run, my country's manufacturing industry still has great growth potential.

MIR Rui Industrial predicts that the year-on-year growth rate of China's industrial robot market is expected to reach about 5%-10% in 2024. The positive trend in the medium and long term remains unchanged. Industrial robots are still an automation product in the growth stage and are expected to continue to maintain double-digit growth in the next few years.

Overall, with the domestic macroeconomic improvement, industrial upgrading and equipment renewal policy support, domestic leading robot manufacturers are developing well, the market structure is being reshaped, the industry is accelerating, and the industrial robot industry will enter a stable development stage. For manufacturers on the track, it is expected to continue to open up room for performance growth.

Yang Jianyong is a contributor to Forbes China. His opinions are his own. He is dedicated to in-depth interpretation of cutting-edge technologies such as the Internet of Things, cloud services, artificial intelligence and smart homes.